Table of Contents

Introduction: Why it’s important to avoid financial mistakes

Financial mistakes can be costly and can lead to long-term financial struggles. Avoiding these mistakes is important to maintain a healthy financial status and secure financial future. In today’s fast-paced world, where the economy is unpredictable and job security is uncertain, it’s essential to have a sound financial plan and make wise financial decisions.

One of the most common mistakes people make is living beyond their means. Overspending can lead to high credit card debt, which can accrue interest and become unmanageable. Another financial mistake is not saving for retirement, which can lead to financial instability during retirement years. Neglecting to have an emergency fund can also be a costly mistake, as unexpected expenses can arise at any time, such as a medical emergency or a home repair.

Avoiding financial mistakes requires financial literacy, discipline, and planning. It’s essential to track your spending, create a budget, and stick to it. Also, investing your money wisely can help grow your wealth over time. Seeking financial advice from a professional can also be helpful in creating a solid financial plan that works for your unique circumstances. Taking these steps to avoid financial mistakes can lead to financial security and peace of mind.

Mistake #1: Living Beyond Your Means

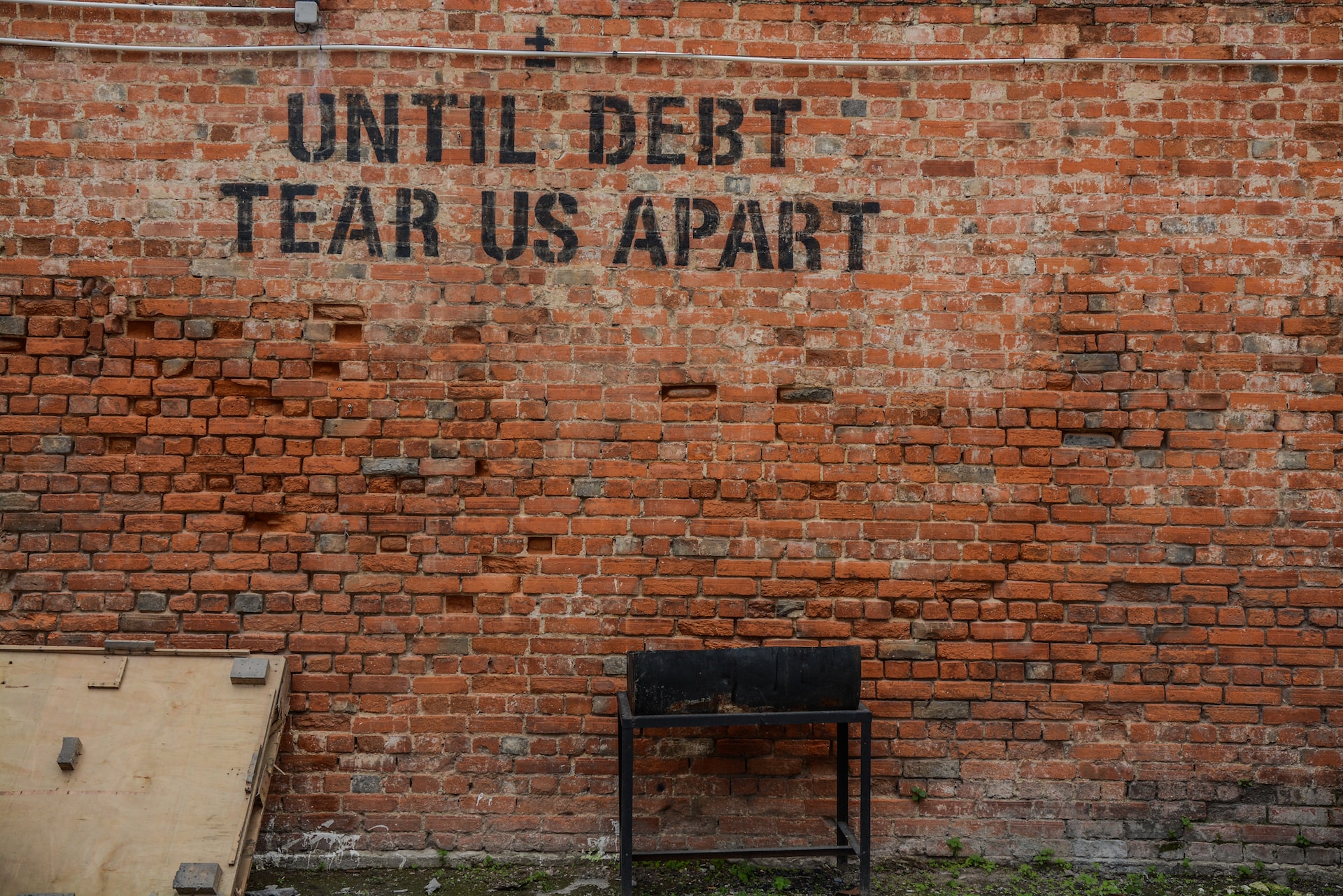

One of the most common mistakes people make is living beyond their means. This happens when you spend more than you earn, which can lead to debt and financial struggles. In today’s consumer-driven culture, it’s easy to fall into the trap of overspending, especially with easy access to credit. However, this can quickly lead to financial stress and uncertainty.

Living beyond your means can be detrimental to your financial health in the long run. It can lead to high levels of debt, including credit card debt and personal loans. This debt can accrue interest and become unmanageable, resulting in missed payments and damaged credit scores. Furthermore, it can also limit your ability to save for future goals, such as retirement or a down payment on a home.

Avoiding this mistake requires discipline and planning. It’s essential to track your spending, create a budget, and stick to it. This can help you identify areas where you can cut back on unnecessary expenses and prioritize your spending. It’s also essential to focus on building an emergency fund and paying down debt. By taking these steps, you can avoid living beyond your means and achieve financial stability in the long term.

Mistake #2: Not Saving for Retirement

Not saving for retirement is a common mistake that can have significant long-term consequences. With longer life expectancies and rising healthcare costs, it’s essential to plan and save for retirement to maintain a comfortable lifestyle in later years. Unfortunately, many people neglect this important aspect of financial planning, which can lead to financial insecurity and uncertainty during retirement.

One of the main reasons people do not save for retirement is due to competing financial priorities, such as paying off debt or saving for a home. While these are essential goals, it’s crucial to prioritize saving for retirement as early as possible. The earlier you start saving, the more time your money has to grow, thanks to compounding interest. Failing to save for retirement can lead to financial stress in later years, where you may have to rely on Social Security or other forms of government assistance to make ends meet.

Avoiding this mistake requires discipline and long-term planning. It’s essential to start saving for retirement as early as possible, even if it’s a small amount. Setting up a retirement savings account can provide tax advantages and employer matching contributions. Regularly reviewing and adjusting your retirement plan as your circumstances change is also essential to ensure you are on track to meet your retirement goals. By taking these steps, you can avoid the mistake of not saving for retirement and achieve financial security in later years.

Mistake #3: Carrying Credit Card Debt

Carrying credit card debt is another common mistake that can have long-term consequences. Credit card debt typically has high-interest rates that can accrue quickly, making it difficult to pay off the balance. Many people fall into the trap of carrying credit card debt, either due to overspending or unexpected expenses. However, carrying this debt can lead to a cycle of missed payments, late fees, and damage to your credit score.

Avoiding this mistake requires discipline and planning. It’s essential to live within your means and avoid overspending on credit cards. Creating a budget and sticking to it can help you prioritize your spending and avoid unnecessary expenses. Additionally, paying off credit card debt as soon as possible is crucial to avoid the cycle of debt. Making more than the minimum payments and focusing on the high-interest debt first can help you pay off the balance more quickly.

Mistake #4: Not Having an Emergency Fund

Not having an emergency fund is a common mistake that can leave you vulnerable to unexpected expenses or job loss. Without an emergency fund, you may have to rely on credit cards or loans to cover expenses, which can lead to a cycle of debt and financial stress. Having an emergency fund can provide a sense of financial security and peace of mind, knowing that you have a cushion to fall back on in case of unexpected events.

Avoiding this mistake requires discipline and planning. It’s essential to prioritize building an emergency fund, even if you are paying off debt or saving for other goals. A good rule of thumb is to aim for three to six months’ worth of living expenses in your emergency fund. Setting up automatic contributions to your emergency fund and keeping it in a separate account can help you avoid the temptation to spend it on unnecessary expenses. By having an emergency fund, you can protect yourself from unexpected financial hardships and maintain financial stability in the long run.

Mistake #5: Not Shopping Around for Insurance

Not shopping around for insurance is a common mistake that can cost you a significant amount of money in the long run. Many people simply renew their insurance policies without reviewing their options, which can lead to paying higher premiums than necessary. Insurance companies offer different rates and coverage options, so it’s essential to shop around and compare policies to get the best deal.

One of the main reasons people do not shop around for insurance is due to the perceived hassle and time commitment. However, the process of getting insurance quotes has become more accessible with online tools and comparison websites. Spending a little time reviewing your insurance options can potentially save you hundreds or even thousands of dollars each year.

Avoiding this financial mistake requires diligence and patience. Start by reviewing your current insurance policies and identifying areas where you may be overpaying or underinsured. Research different insurance companies and compare rates and coverage options. When you find a policy that fits your needs and budget, be sure to review the details carefully and ask questions before making a final decision. By shopping around for insurance, you can save money and ensure that you have the right coverage for your needs.

Mistake #6: Not Tracking Your Spending

Not tracking your spending is a common financial mistake that can make it difficult to stay on top of your finances. Without an accurate picture of where your money is going, it’s easy to overspend, miss bill payments, and fall into debt. Tracking your spending is an essential part of financial planning, allowing you to identify areas where you may be overspending and make adjustments to your budget.

Avoiding this financial mistake requires discipline and awareness. There are many tools and apps available that can help you track your spending, from spreadsheets to budgeting apps. Start by reviewing your bank and credit card statements to get an idea of where your money is going each month. Categorize your expenses, such as housing, food, transportation, and entertainment, and set a budget for each category. Be sure to track your spending regularly and adjust your budget as needed to stay on track.

Mistake #7: Not Investing Your Money

One of the most significant financial mistakes people make is not investing their money. While saving is important, investing allows your money to grow and work for you. Not investing can mean missing out on long-term growth potential and failing to achieve financial goals such as retirement, buying a home, or funding education. By not investing, you’re essentially leaving money on the table.

One of the primary reasons people do not invest is due to the perceived complexity and risk involved. However, investing does not have to be complicated, and there are options available for all levels of risk tolerance. There are various investment vehicles such as stocks, bonds, mutual funds, exchange-traded funds, and more. It’s essential to understand the differences between these options, their risks, and returns, to determine which one aligns with your goals.

To avoid this financial mistake, it’s crucial to start investing as early as possible. The earlier you start, the more time your investments have to grow. Even if you can only invest small amounts, it’s important to start somewhere. It’s also essential to develop a well-diversified investment portfolio to manage risks and maximize returns. Consider working with a financial advisor to help you develop an investment plan that aligns with your goals and risk tolerance.

Mistake #8: Co-signing a Loan

Co-signing a loan is when you agree to take responsibility for someone else’s debt. This is a significant financial mistake that can have serious consequences. When you co-sign a loan, you become legally responsible for the debt if the primary borrower defaults on payments. This means that if the borrower fails to pay, the lender can come after you for the money. Co-signing a loan can also impact your credit score and make it difficult to get approved for future loans.

It’s important to understand the risks involved before co-signing a loan. While you may be helping someone in need, you could end up paying off the debt yourself if the borrower defaults. Before agreeing to co-sign a loan, make sure you have a clear understanding of the borrower’s ability to repay the debt. Consider other options such as a personal loan or helping the borrower improve their credit score before agreeing to co-sign a loan.

Mistake #9: Not Reviewing Your Credit Report Regularly

Your credit report is a crucial aspect of your financial health, as it determines your ability to obtain loans, credit cards, and other financial products. However, many people make the mistake of not regularly reviewing their credit report. This can lead to errors or fraudulent activity going unnoticed, which can negatively impact your credit score and financial standing.

It’s important to review your credit report at least once a year to ensure that all the information is accurate and up-to-date. You can request a free credit report from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. Reviewing your credit report regularly can help you identify errors or fraudulent activity and take action to correct them. This can also help you identify areas where you can improve your credit score and financial standing.

Mistake #10: Ignoring Your Taxes

Ignoring your taxes can be a costly financial mistake. Failing to file your taxes or pay your taxes on time can result in penalties and interest charges. If you continue to ignore your taxes, the IRS can take legal action against you, such as placing a tax lien on your property or garnishing your wages. It’s important to take your tax obligations seriously and ensure that you file your taxes and pay any taxes owed on time.

It’s also important to ensure that you’re taking advantage of any tax deductions or credits that you’re eligible for. This can help you reduce your tax liability and save money. Common tax deductions and credits include mortgage interest, charitable donations, and education expenses. By working with a qualified tax professional or using tax software, you can ensure that you’re taking advantage of all available tax benefits.

Conclusion

In conclusion, avoiding financial mistakes is critical to achieving long-term financial stability and success. By avoiding common financial mistakes such as living beyond your means, not saving for retirement, carrying credit card debt, and not having an emergency fund, you can ensure that you’re on track to achieve your financial goals.

It’s important to take a proactive approach to your finances, which involves creating a budget, tracking your spending, and making smart financial decisions. This includes saving for retirement, building an emergency fund, shopping around for insurance, and investing your money wisely. By taking these steps, you can protect your financial future and ensure that you’re well-prepared to handle any financial challenges that may arise.

Ultimately, achieving financial success requires discipline, patience, and a willingness to make smart financial decisions. By avoiding common financial mistakes and adopting sound financial habits, you can achieve your financial goals and build a secure financial future for yourself and your family.